A single tweet from one man can move billions of dollars in market value within minutes. This extraordinary power belongs to Elon Musk, whose investment decisions and public statements have redefined the relationship between social media and financial markets.

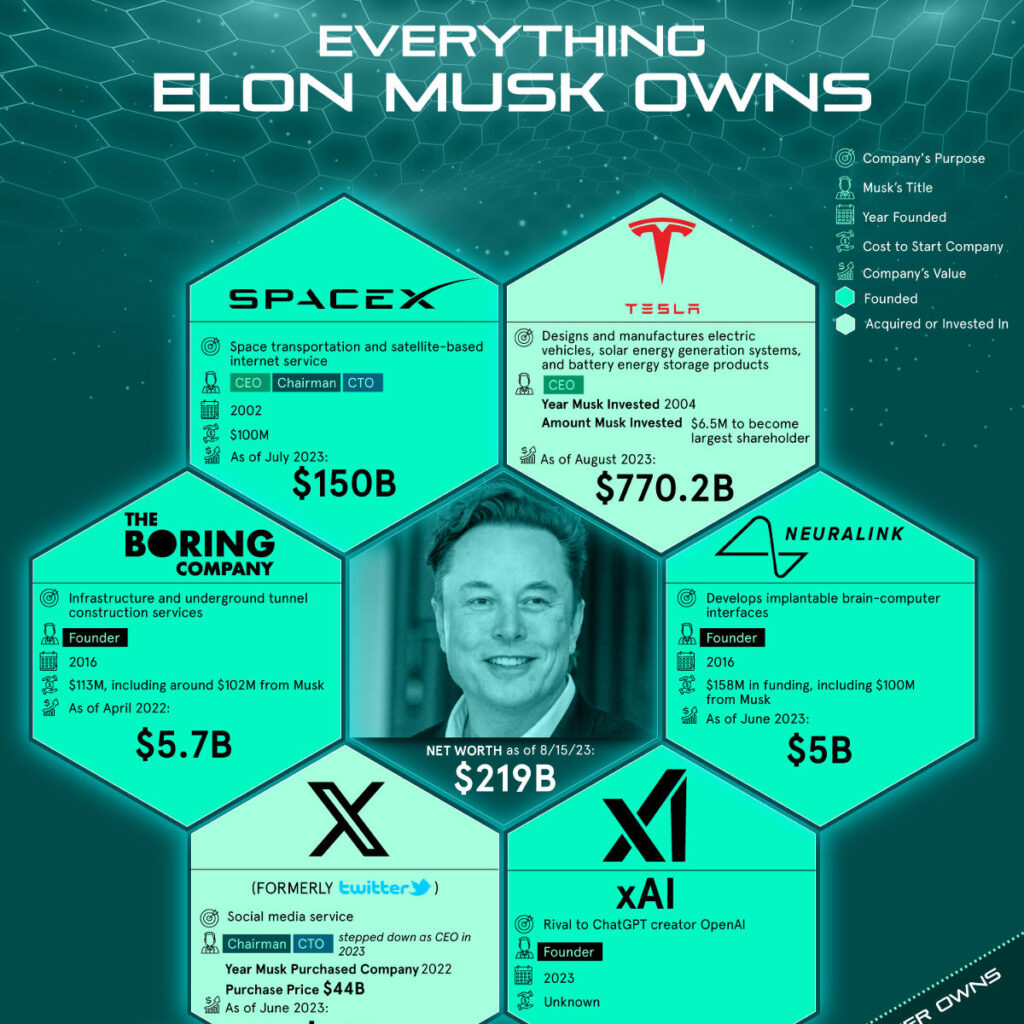

- Tesla ( 797 billions)

- SpaceX (210 billions)

- PayPal (77 billions)

- XAI (40 billions)

- X (19 billions)

- Neuralink (8 billions)

- The Boring Company (7 billions)

As the world’s wealthiest individual, Musk’s investment empire spans from electric vehicles to space exploration, cryptocurrencies to artificial intelligence. His portfolio not only shapes industries but creates market phenomena, with the “Musk Effect” becoming a recognized force in global finance.

Elon Musk’s Investment Empire: A Deep Dive into His Most Influential Holdings

The Tech Visionary’s Market Impact

Elon Musk stands as one of the most influential figures in modern business, wielding unprecedented power over financial markets through his investments and public statements. As a serial entrepreneur and investor, his portfolio spans multiple industries, from electric vehicles to space exploration. His position as the world’s richest person, though fluctuating, stems primarily from his stakes in transformative companies like Tesla and SpaceX.

Musk’s presence on X (formerly Twitter) has become legendary in investment circles. His tweets can trigger immediate market reactions, moving billions in market value within minutes. This digital influence extends beyond his own companies, affecting entire sectors and even unrelated businesses that share names with his endorsements.

Tesla: The Crown Jewel

Tesla remains Musk’s most valuable public investment, despite recent market challenges. The electric vehicle manufacturer faces headwinds from rising interest rates and shifting demand patterns. However, Tesla’s influence in the automotive sector continues to grow, forcing traditional manufacturers to accelerate their electric vehicle programs.

The company’s stock price demonstrates remarkable sensitivity to Musk’s public communications. His 2018 tweet about potentially taking Tesla private caused an 11% surge in stock value within hours, highlighting the extraordinary market-moving power of his social media presence.

Cryptocurrency Ventures

Musk’s relationship with cryptocurrencies has significantly impacted the digital asset landscape. Tesla’s $1.5 billion Bitcoin investment marked a watershed moment for institutional crypto adoption. His subsequent decision to suspend Bitcoin payments for Tesla vehicles, citing environmental concerns, demonstrated his ability to influence crypto market sentiment.

Beyond Bitcoin, Musk’s tweets about Dogecoin have repeatedly caused dramatic price movements in the meme-inspired cryptocurrency. His social media activity continues to be a crucial factor in crypto market volatility, influencing both retail and institutional investor behavior.

SpaceX and Private Holdings

SpaceX represents Musk’s ambitious push into space exploration and satellite communications. Though privately held, the company’s estimated value exceeds $210 billion, making it a cornerstone of his investment portfolio. The success of SpaceX’s reusable rocket technology and Starlink satellite network has revolutionized space industry economics.

Market Influence and Regulatory Scrutiny

Musk’s market influence has attracted significant regulatory attention. The SEC’s $20 million fine following his Tesla privatization tweets underscores the scrutiny his market-moving communications face. Despite regulatory challenges, his impact on investor behavior remains substantial, particularly among retail investors who closely follow his social media activities.

Investment Philosophy and Future Focus

Musk’s investment strategy centers on transformative technologies and long-term innovation. His early involvement in PayPal demonstrated his ability to identify revolutionary financial technologies. Current investments in artificial intelligence and sustainable energy reflect his commitment to future-focused technologies that can reshape entire industries.

His approach often involves taking active operational roles in his investments, distinguishing him from traditional passive investors. This hands-on strategy has proven particularly effective in driving technological advancement and market adoption across his portfolio companies.

Beyond Individual Companies

Musk’s influence extends beyond his direct investments. His public statements about technologies or companies can trigger broader market movements, affecting entire sectors. For instance, his endorsements of specific technologies often lead to increased investor interest in related companies and market segments.

This market-moving capability has created what some analysts call the “Musk Effect” – a phenomenon where his public statements can cause rapid shifts in market valuations and investor sentiment across multiple sectors simultaneously.

Through his varied investments and public presence, Musk continues to shape market trends and investment patterns in unprecedented ways. His focus on revolutionary technologies and sustainable innovation suggests his influence on global markets will likely persist and potentially grow in the coming years.

The Future of Musk’s Investment Influence

As markets continue to evolve, Elon Musk’s investment influence shows no signs of waning. His unique combination of operational expertise, technological vision, and social media presence has created a new paradigm for how individual investors can shape global markets.

Whether through Tesla’s electric revolution, SpaceX’s space innovations, or his cryptocurrency endeavors, Musk’s investment decisions will likely continue to ripple through the financial world. His focus on transformative technologies suggests that his portfolio will remain at the forefront of global innovation and market trends.